Work Requirements for Able-Bodied Adults Without Dependents

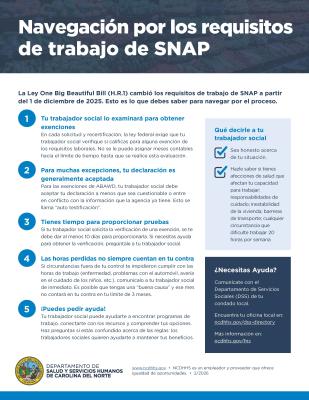

H.R. 1 (the One Big Beautiful Bill Act) changed who needs to meet work requirements to qualify for food and nutrition services (FNS/SNAP) benefits. Your county's department of social services will screen you for exemptions during your next recertification.

There are two types of work rules: General Work Registration (ages 16-59) and Able-Bodied Adults Without Dependents (ABAWD) Time Limits (ages 18-64). Many people qualify for exemptions from one or both. Use the screener below to find out what applies to you.

Communications Toolkit (English)

| Preview Image | Download Link and Caption |

|---|---|

| Caption: New changes to SNAP work rules went into effect on Dec. 1. Some people ages 18-64 who were previously exempt, such as veterans, may now be subject to work requirements. To learn more about the new rules, visit ncdhhs.gov/fns. |

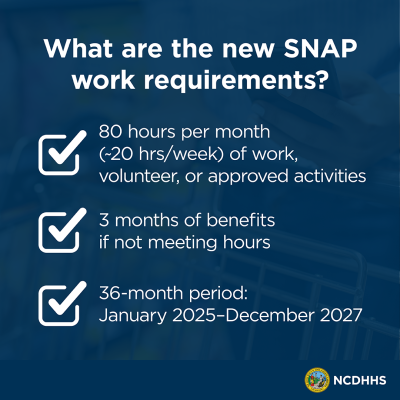

| What's Required

|

| H.R.1 Context Caption: The One Big Beautiful Bill Act (H.R.1) changed SNAP work requirements effective December 1, 2025. If you receive SNAP benefits and are ages 18-64, you may be affected. Your county DSS will screen you for exemptions at your next recertification. Visit ncdhhs.gov/fns to learn more. |

| Caption: Are you worried about new SNAP work requirements? Many people qualify for exemptions. If you are pregnant, have a disability, live with a child under 14, or have health conditions that limit your ability to work, you may be exempt. Your county DSS will screen you for all exemptions. Learn more: ncdhhs.gov/fns. |

| Caseworker Screening Caption: Your county Department of Social Services will screen you for all SNAP work requirement exemptions during your next recertification. You don't need to do anything special: just be honest about your situation. Many exemptions are available based on age, health, caregiving, and other circumstances. Visit ncdhhs.gov/fns for details. |

| Veterans Caption: Veterans: If you receive VA disability compensation at ANY percentage you may be exempt from SNAP work requirements. Make sure your caseworker knows about your VA benefits. Learn more at: ncdhhs.gov/fns. |

| More Than a Job NC Caption: Need help meeting SNAP work requirements? More Than a Job NC offers free job training, education programs, and work opportunities. Ask your caseworker or visit ncdhhs.gov/morethanajob. |

| Where to Learn More Caption: Have questions about new SNAP work requirements? Visit ncdhhs.gov/fns for details. Contact your local county DSS: ncdhhs.gov/dss-directory. Ask your caseworker at your next recertification. Your county DSS will screen you for all exemptions. |

Kit de herramientas de comunicación (Español)

Policy Content

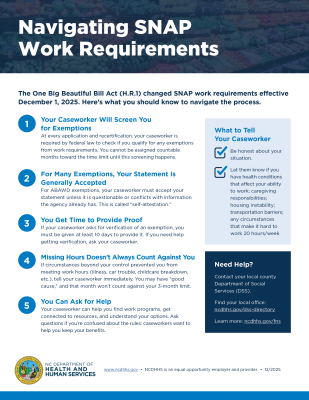

Here's how the ABAWD exemption screening process works:

Right 1: Your caseworker must screen you for exemptions.

At every application and recertification, your caseworker is required by federal law to check if you qualify for any exemptions. You cannot be assigned countable months toward the time limit until this screening happens. During your recertification, it is important to review and learn about the work requirements with your caseworker.

Right 2: You get time to provide proof.

If your caseworker asks for verification of an exemption, you must be given at least 10 days to provide it.

Right 3: Missing hours don't always count against you.

If circumstances beyond your control prevented you from meeting work hours, tell your caseworker immediately. You may have 'good cause,' and that month won't count against your 3-month limit.

Right 4: You can ask for help.

If you need help verifying an ABAWD exemption, ask your caseworker for assistance. If your own statement is not sufficient for verification for exemptions, there are various ways that your caseworker can attempt to help you verify that you meet an exemption.

Remember: During your application or recertification interview, let your caseworker know if you have a condition or situation that may affect your ability to meet the work requirements. This helps them assess whether an exemption applies to you.

Key Takeaways

- Your caseworker must screen you for exemptions at every application and recertification.

- You have at least 10 days to provide verification, if needed.

- Good cause can protect you if you miss hours due to circumstances beyond your control.

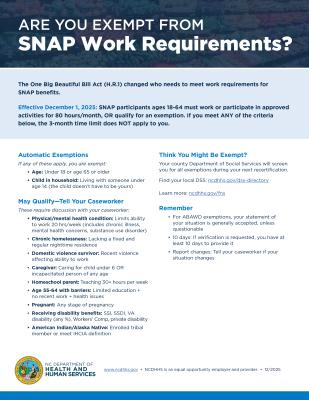

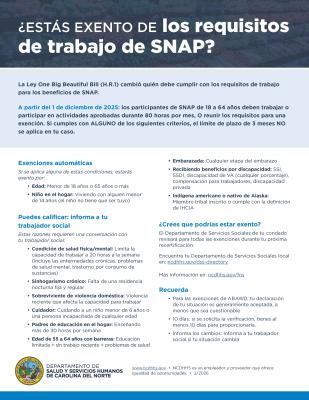

Are You Exempt from the ABAWD Time Limit?

If any of the following apply to you, the 3-month time limit does NOT apply. Tell your caseworker about your situation.

Exemptions

If any of these apply, you are exempt.

- Age: Under 18 or age 65 or older

- Child in Household: Living in a household with a child under age 14. You do not need to be the child's parent or guardian to be exempt.

- Pregnant: Any stage of pregnancy

- Receiving Disability Benefits: From any source. SSI, SSDI, VA disability (any percentage rating), Workers' Compensation, private disability. Verification required.

- Physically or Mentally Unfit for Employment: Limits ability to work 20 hrs/week. A person does not need to meet a specific definition of 'disabled' or to be receiving disability benefits to meet this criterion. If a chronic illness, mental health conditions, substance use disorder, or other conditions limit a person's ability to work 20 hrs/week, they may be exempt. If obvious, no documentation needed. If not obvious, may require a medical statement.

- Chronic Homelessness: Lacking a fixed and regular nighttime residence. Includes shelters (including domestic violence shelters), vehicles, outdoors, or other places not designed for regular sleeping.

- Domestic Violence Survivor: Recent violence affecting ability to work.

- Caregiver: Caring for a child under 6 OR an incapacitated person of any age. The person does not have to live with you or be in your FNS household, as long as you are the one providing the care.

- Homeschool Parent: Teaching 30+ hours per week. Qualifies under the general work registration exemption (30+ hours of work activity).

- Age 55-64 with Multiple Barriers: Combined factors. Limited education (no diploma/GED) + no recent work history + health conditions. All three factors must be present.

Key Takeaway

- Multiple exemptions can apply - if one exemption ends, another may still protect you.

FNS has two separate sets of work-related rules. You may be subject to one, both, or neither, depending on your situation.

General Work Registration (FNS 240)

People ages 16-59 must:

- Register for work (your caseworker does this for you)

- Accept suitable job offers

- Not voluntarily quit a job without good cause if working 30 or more hours/week (or earning $217.50+/week)

- Not voluntarily reduce work hours below that threshold without good cause

You may be excused if you are:

- Working 30+ hours/week (or earning equivalent wages)

- Meeting Temporary Assistance for Needy Families (TANF) or unemployment work requirements

- Caring for a child under 6 or an incapacitated person

- Unable to work due to physical/mental limitations

- In an alcohol or drug treatment program

- A student at least half-time

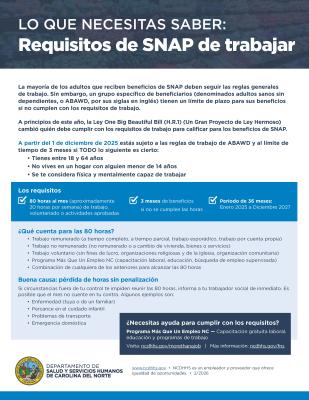

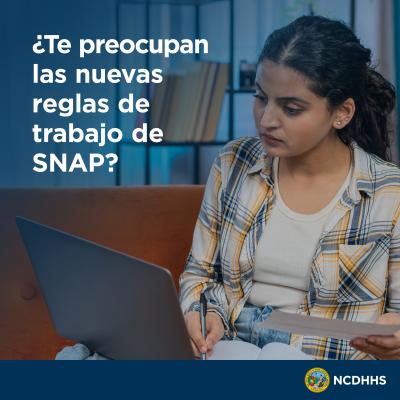

ABAWD Time Limits (FNS 260)

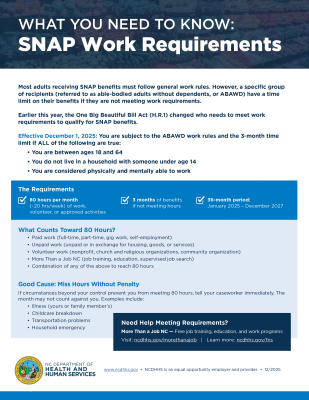

Effective Dec. 1, 2025, you are subject to the 3-month time limit if ALL of the following are true:

- You are between the ages of 18 and 64

- No one under age 14 lives in your household

- You are physically and mentally able to work

Requirement: Work, volunteer, or participate in approved activities for 80 hours per month (about 20 hours/week).

Time limit: Without meeting this requirement or qualifying for an exemption, benefits are limited to 3 months in a 36-month period. Current period: Jan 1, 2025 - Dec 31, 2027.

Important Distinction Note: You can be subject to one set of rules but not the other.

Exempt from general work registration but still subject to ABAWD: If you're 60-64, you don't have to register for work, but you may still need to meet the 80-hour requirement unless you have another exemption.

Subject to general work registration but exempt from ABAWD: If you're age 50 and live with a 10-year-old child, you must register for work but are exempt from the 3-month time limit.

We understand that this may be confusing.Your caseworker will explain which rules apply to you.

How to Meet the 80-Hour Requirement

If you're not exempt, you need to work or participate in approved activities for at least 80 hours per month (about 20 hours per week). Here's what counts:

Key Numbers

- 80 hours per month (~20 hrs/week)

- 3 months of benefits if not meeting hours

- 36-month period (Jan 2025 - Dec 2027)

Activities Table

| Paid Work | Examples | Counts? |

|---|---|---|

| Paid Work | Full-time, part-time, temp jobs, gig work (Uber, DoorDash), self-employment | Yes |

| Unpaid Work | Work or labor for which the person receives no direct monetary compensation, such as caregiving for children, older adults, or people with disabilities who you do not have a legal responsibility for. Can also be work done in exchange for goods, services, or housing. | Yes |

| Volunteer Work | Nonprofit, church, community organization, government agency, court-ordered service | Yes |

| More Than a Job NC | Job training, education (GED, vocational), supervised job search through state program | Yes |

| Combination | Mix any of the above to reach 80 hours (e.g., 40 work + 40 volunteer) | Yes |

| Job Search Only | Looking for work without other activities | No |

*Job search can count for up to 25% of your hours if you're in a work program, but not on its own.

Need Help Meeting Requirements?

More Than a Job NC - Free job training, education, and work programs that count toward your 80-hour requirement.

Tips for Meeting the Requirement

- Track your hours - Keep a log of when you work, volunteer, or participate in activities

- Report your hours - Make sure your caseworker knows about all your work activities

- Combine activities - You can work 40 hours and volunteer 40 hours to reach 80 hours

- Ask about More Than a Job NC - This free state program can help you meet requirements while gaining skills

Important: Report Changes

You must report if your work hours drop below 80 per month by the 10th of the following month. Example: If your hours drop in March, report by April 10.

Key Takeaways

- 80 hours/month is the requirement - average about 20 hours per week

- Mix activities - work, volunteering, job training, and job search all count

- More Than a Job NC can help you meet requirements while building skills

- Report drops in hours by the 10th of the following month

What If You Can't Meet the Hours? (Good Cause)

Life happens. If circumstances beyond your control prevent you from meeting 80 hours in a month, tell your caseworker immediately. You may have "good cause," and that month won't count against your 3-month limit.

Good Cause Includes:

- Illness - Your own or caring for a sick family member

- Household Emergency - Eviction, utility shutoff, natural disaster

- Transportation Problems - Vehicle breakdown, no public transit, can't afford gas

- Childcare Breakdown - Your regular childcare fell through

- Court/Legal Obligations - Court appearances, mandatory appointments

- Medical Appointments - Doctor visits, mental health services, treatment

- Other Circumstances - Anything a reasonable person would consider valid

How Good Cause Works

- Tell your caseworker right away - Don't wait until your next recertification

- The month doesn't count - If good cause is approved, that month won't count toward your 3-month limit

- It's temporary - Good cause covers temporary situations, not permanent ones

What If You've Used Your 3 Months?

If you've received 3 months of benefits without meeting the work requirement, your FNS benefits will stop. But you can regain eligibility.

How to Regain Eligibility

- Work 80 hours in any 30-day period. This doesn't have to be a calendar month. Once you complete 80 hours, contact your caseworker to reapply.

- Become exempt. If your situation changes (you become pregnant, start receiving disability benefits, move in with a child under 14, etc.), you're exempt and can receive benefits again.

- Wait for the period to end. The current 36-month period ends on December 31, 2027. A new period will start Jan. 1, 2028.

Bonus Months

If you regain eligibility by working 80 hours but then stop working, you may be eligible for 3 additional consecutive months of benefits. These are called "bonus months."

Key Rules

- You can only use bonus months once per 36-month period

- The 3 months must be consecutive (back-to-back)

Bonus months start when you report that you're no longer meeting the work requirement

Frequently Asked Questions

Maybe not. While Social Security Retirement doesn't automatically exempt you, you may qualify for an exemption based on your health condition. If you have physical or mental health issues that prevent you from working 20 hours per week, tell your caseworker. They can determine if you're 'unfit for employment' and exempt from the time limit.

It depends. If you're 60-64: You are exempt from general work registration (you don't have to register for work or accept job offers). You may still be subject to the ABAWD 80-hour requirement unless you have another exemption. If you have health conditions, care for someone, or meet other exemption criteria, tell your caseworker.

'Unfit for employment' means you have a physical or mental condition that prevents you from working 20 hours per week. If your condition is obvious to your caseworker, no documentation is needed. If not obvious, you can get a statement from many types of professionals—not just doctors. Acceptable sources include nurses, social workers, counselors, therapists, and addiction counselors.

Use your app's work history or earnings statements to show hours worked. If the app doesn't track hours clearly, keep a personal log and provide a signed statement of your monthly hours. As long as you average 80 hours per month, you meet the requirement.

Yes. In North Carolina, veterans receiving VA disability compensation at any percentage—including 20%, 40%, or any other rating—are exempt from the ABAWD time limit. Make sure your caseworker knows you receive VA disability benefits.

Federal law did eliminate homelessness as an automatic exemption category. However, North Carolina recognizes that chronic homelessness creates barriers to employment. If you lack a fixed and regular nighttime residence and it prevents you from working, tell your caseworker—you may be found exempt as 'obviously unfit for employment.'

Yes, if you provide homeschool instruction for 30 or more hours per week, you are exempt from ABAWD work requirements. This counts as meeting the general work registration requirement (30+ hours of work activity), which then exempts you from ABAWD.

If you usually meet the requirement but fall short due to circumstances beyond your control (illness, car trouble, childcare issues, etc.), tell your caseworker right away. This may be 'good cause,' and the month won't count against your limit. Don't wait—report immediately.

Resources and Contacts

- Find Your Local DSS. Contact your county Department of Social Services to speak with a caseworker about your situation.

- More Than a Job NC. Free job training, education, and work programs that count toward your 80-hour requirement.

- NCWorks Career Centers. Free job search help, resume assistance, and training opportunities at locations across North Carolina.

- Medical Report Form. If you need to document a health condition that affects your ability to work, your provider can complete this form.

If you received a notice that your benefits are ending, or if you believe you qualify for an exemption, contact your local DSS immediately. Don't wait.